Unpacking the Major Legislative Changes

The recent signing of the 2025 budget reconciliation package, known fondly in political circles as the “One Big Beautiful Bill Act,” has ignited discussions across the nation. The law, enacted on July 4, 2025, and endorsed by President Trump, is poised to overhaul key facets of Medicaid and the Affordable Care Act (ACA) Marketplaces. According to KFF, estimates from the Congressional Budget Office (CBO) project that by 2034, modifications to these platforms could result in a staggering increase of 10 million uninsured individuals nationwide.

Nationwide Shifts and Projections

The CBO warns of a potential 14 million bump in uninsured figures by 2034 when the new legislation aligns with the expiration of current premium tax credits under the ACA. While this estimation skirts the full impact of the administration’s supplementary ACA rules, the projected rise underscores the pivotal shifts awaiting the American public.

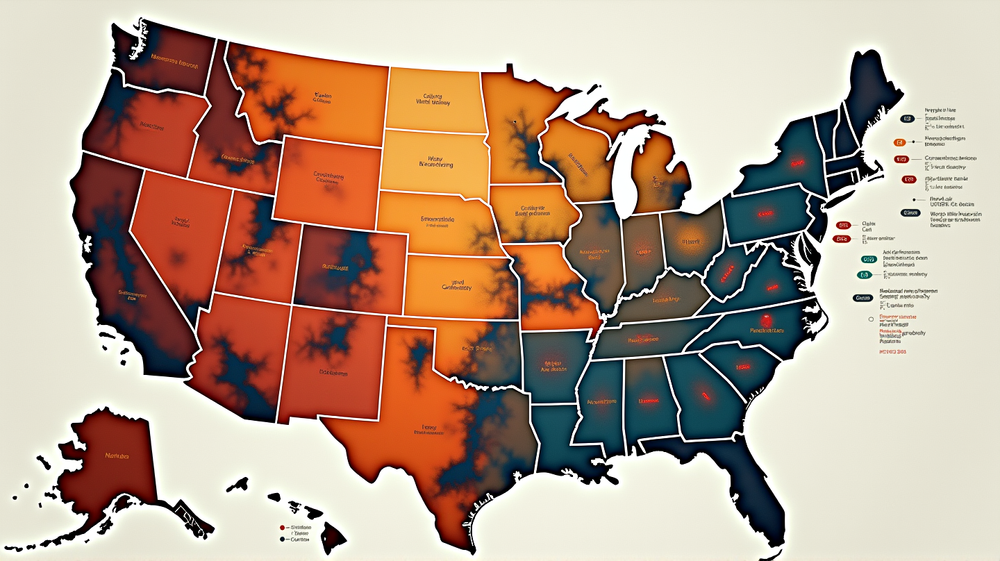

State-by-State Impact Analysis

The thorough analysis apportions expected increases in uninsured rates across all 50 states and the District of Columbia. Alarmingly, 20 states, plus D.C., are bracing for rate hikes of 3 percentage points or more—this before even considering the expiration of enhanced tax credits. With populous states such as California, New York, and Florida expecting significant uninsured growth, the repercussions seem poised to ripple extensively.

Contributing Factors and Variables

Central to the debate is the indeterminate response states might have toward the alterations, particularly around Medicaid policy. The CBO outlines that over half of the estimated uninsured increase is linked to proposed Medicaid work requirements, yet local variances in execution remain a major wildcard.

Future Implications and Dynamic Changes

While the expected climax in uninsured persons hangs at 14.2 million, the intricacies of policy interactions and electoral enrollees push the narrative further into unknown territories. The soon-to-be concluded enhanced tax credits, when juxtaposed with the reconciliation law, promise substantial challenges for states such as Louisiana, Arizona, and Florida, with uninsured hikes surpassing 5 percentage points anticipated.

Wrapping Up: Understanding the Broader Spectrum

In summary, the enactment of this reconciliation law layers complex dynamics on the healthcare fore. As state governments and lawmakers grapple with the specifics, individuals, particularly in severely affected areas, brace for significant shifts in access to health insurance. A thorough understanding of these legislative implications can prepare citizens and policymakers alike for inevitable changes coming their way.